This negative details remains on your credit report declare an optimum of 6 years, so if you're unclear that it still exists you should examine your credit history report. You can do this through a credit scores recommendation firm such as Experian or Equifax. Programs exist for individuals with reduced ratings or even no credit score whatsoever.

New American Financing supplies a variety of finance options, evaluates borrowers based upon hands-on underwriting, and also supplies guidance for deposit assistance programs. That indicates they will certainly assess facets of your monetary circumstance, like on-time rental fee and utility settlements, that aren't normally reported to the credit report bureaus. You'll have to provide the lending institution with paperwork of this information. If you currently have a conventional financing but your credit report isn't high enough for a conventional cash-out re-finance, an FHA cash-out re-finance could assist you access your home equity.

- Recent and frequent debt rejections can antagonize you when obtaining a mortgage as lending institutions may question why previous loan providers refused to provide to you.

- Yes, however it will certainly rely on many variables such as when the CCJ was signed up, just how much the CCJ was for and also have you handled to please the CCJ.

- It's their work to find you a lending institution with affordable terms so that when you obtain authorized, the repayments are workable as well as have the adaptability you need.

- The lender will take a look at your credit score, work information, plus other information such as your payment background to examine your level of danger.

- You can contrast the LTVs and interest rates on all home loans from the independent home loan lenders that will certainly not immediately decline you because you are freelance.

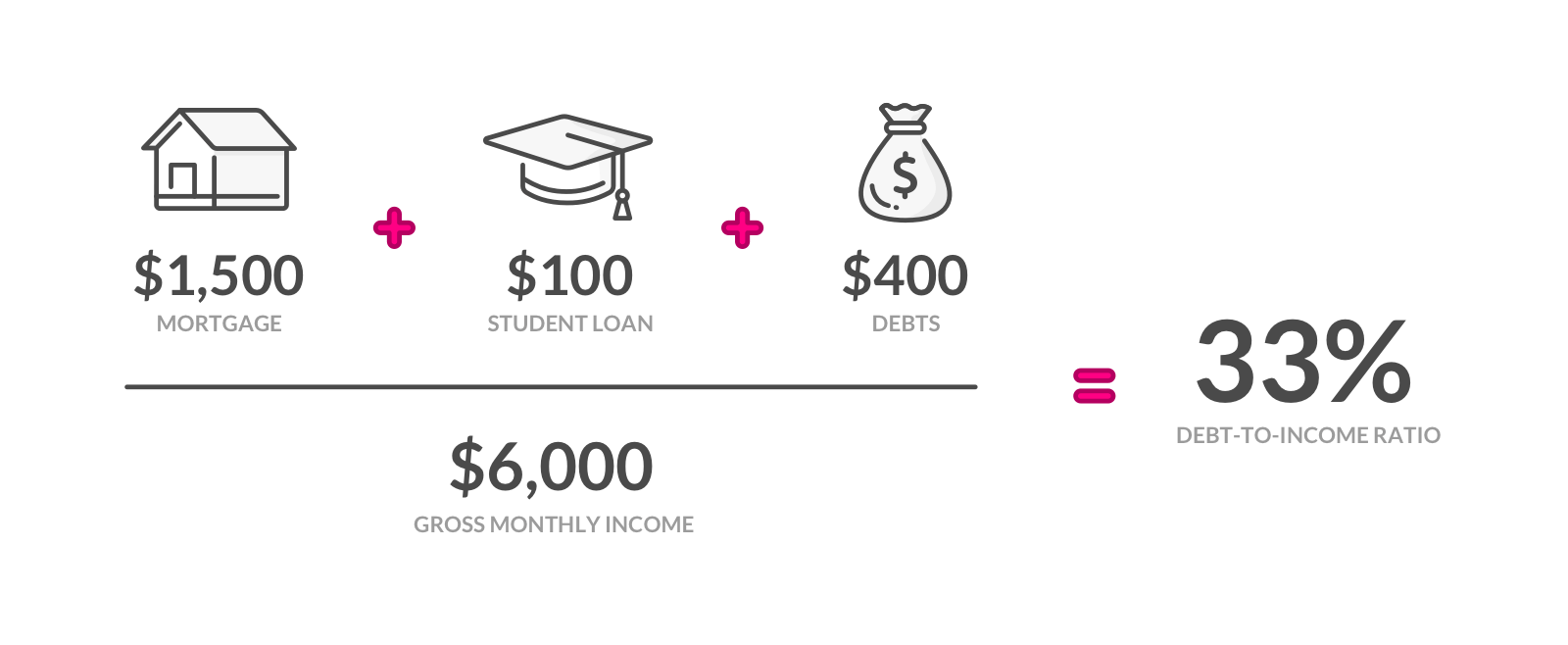

We are experts in aiding customers that have actually bad credit score registered such as CCJ's, defaults, missed settlements and home loan defaults. Bad credit history commercial home loans are additionally helpful for those trying to find industrial properties with a bad credit report. Also if you're just accepted for a card that offers a low credit limit and also a high rates of interest, loan providers will certainly find out to trust you if you pay it off in full each month. To help make up for your reduced credit score, show steady income that is sufficient to pay the loan. Get rid of as much financial debt as possible, as a high debt-to-income ratio will certainly make it even harder to get a loan. Having extremely little or nothing else outstanding debt will make your finance application appear more powerful.

Totally personalized home loan prices not offered without giving get in touch with info. Alterra Home Loans supplies conventional loans for just 3% down. Carrington Home mortgage Services supplies traditional fundings for just 3% down. Northpointe offers traditional financings with just 3% down. There are other means to qualify for a mortgage with negative credit score, too.

Best Home Loans For Self Employed

For the most part, conventional loans require a 620 minimum credit history, whereas FHA and also CitiMortgage's HomeRun home mortgage might be lower. Wells Fargo sticks out as the top conventional bank for customers with poor credit report because of prospective partnership discount rates and also openness in prices. Prior to completing an application, you can conveniently contrast different finance types and also obtain a price quote of rates of interest based on your credit score array. Theoretically, that score enables you to get approved for a financing backed by the Federal Real Estate Administration with a 10% down payment. Bringing up your credit report can provide you extra lending choices, get you a reduced rate of interest and also enable you to make a smaller sized down payment.

Why Choose Mortgagekey For Bad Credit Rating Home Mortgages

In dire scenarios, stating yourself insolvent might be your only alternative. A lot of high road lending institutions will certainly reject to lend to people with an insolvency on their document, even if it took place in the distant past. Also if the lender agrees to go for a smaller quantity, the CCJ may be videotaped get out of bluegreen timeshare as 'partially satisfied' on your record as well as could potentially westlake timeshare count against your home loan application.

These can all result in a average timeshare cost 2020 negative credit score, limiting your finance alternatives. Also if you have poor credit report, lending institutions may look past just your credit report to analyze your scenario. Having a few small problems in your past, such as the strange late settlement on your phone agreement, must not quit you from getting a home loan.